The Truman Show Stock Market - How Things Look And What They Are

Stock-Markets / Stock Markets 2014 Jul 07, 2014 - 03:49 AM GMTBy: Raul_I_Meijer

We hugely underestimate what it means not to have a functioning financial system and economy. It even feels sort of fine for a while, both to the richer part of our population who get richer, and to the rest who fall for the dream that things in their lives will get better again soon. But there is still a big difference between what things look like, and what they really are. And one day we will need to snap out of the dream and face reality.

We hugely underestimate what it means not to have a functioning financial system and economy. It even feels sort of fine for a while, both to the richer part of our population who get richer, and to the rest who fall for the dream that things in their lives will get better again soon. But there is still a big difference between what things look like, and what they really are. And one day we will need to snap out of the dream and face reality.

Because there will come a point when people across the board will want to know what things are truly worth, not what someone wants them to think they are. People will want to find out what the prices is they pay to maintain the illusion. And the rich will want to keep getting richer; that urge is built into the system.

Volatility is awfully low, and that makes it impossible for some people to make money; betting against certain stocks or companies or bonds is no longer possible, even if their values don’t represent what goes on beneath the veil. Companies and countries that are not doing well at all, cannot be ‘punished’ for their poor performance. They can instead go out and borrow even more, and cheap, so their underlying numbers only get worse while they look to be sitting pretty.

Back in March, Tyler Durden posted a piece by Seth Klarman of Baupost Group, who wrote the stock market resembles a Rorschach test: “what investors see in the inkblots says considerably more about them than it does about the market.” And it’s really a Truman Market, with the Fed as “creators”:

Welcome to “The Truman Show” market. [..] The world Truman inhabits turns out to be phony: a gigantic sound stage created for a manufactured “reality.” As Truman starts to unravel the truth, his anger erupts and chaos ensues. Ben Bernanke and Mario Draghi, as in the movie, are the “creators” who have manufactured a similarly idyllic, if artificial, environment for today’s investors. They were the executive producers of “The Truman Show” of 2013. A global audience sat in rapt attention before this wildly popular production. Given the U.S. stock market’s continuing upsurge, Bernanke is almost certain to snag yet another People’s Choice Award for this psychological “thriller.” Even in “The Truman Show,” life was not as good as this for investors.

But there is one fly in the ointment: in Bernanke’s production, all the Trumans – the economists, fund managers, traders, market pundits – know at some level that the environment in which they operate is not what it seems on the surface. The Fed and the Treasury openly discuss the aim of their policies: to manipulate financial markets higher and to generate reported economic “growth” and a “wealth effect.” Inside the giant Plexiglas dome of modern capital markets, just about everyone is happy, the few doubters are mocked and jeered, bad news is increasingly ignored, and markets go asymptotic. The longer QE continues, the more bloated the Fed balance sheet and the greater the risk from any unwinding. The artificiality of today’s markets is pure Truman Show. According to the WSJ, the Federal Reserve purchased about 90% of all the eligible mortgage bonds issued in November.

Like a few glasses of wine with dinner, the usual short-term performance pressures on most investors to keep up with the market serve to dull their senses, which makes it a bit easier to forget that they are being manipulated. But what is fake cannot be made real. As Jim Grant recently noted on CNBC, the problem is that “the Fed can change how things look, it cannot change what things are.” According to John Phelan, a fellow at the Cobden Centre in the U.K., “the Federal Reserve has become an enabler of the financial havoc it was designed (a century ago) to prevent.”

Durden returned to the Klarman piece when commenting on the demise of another hedge fund, Emrys Partners. Whatever you think about hedge funds, and I’m sure for many there’s no love lost there, if all is well they do perform an important function in keeping the system healthy. Emrys’ Steve Eisman says that is no longer possible, and so he closes the doors.

“Making Investment Decisions Based On Fundamentals Is No Longer A Viable Philosophy”

Yet another in a long stream of relatively esteemed hedge fund managers has decided enough-is-enough and is shuttering his firm. The reason? Same as the rest… As WSJ reports, Steve Eisman, who emerged as one of the stars of the financial crisis with a winning bet against mortgages, has wound up his fund because he believes that “making investment decisions by looking solely at the fundamentals of individual companies is no longer a viable investment philosophy.” As WSJ reports,

Steve Eisman, who emerged as one of the stars of the financial crisis with a winning bet against mortgages, is shuttering his hedge-fund firm, according to people familiar with the matter. [..] While Emrys gained 3.6% and 10.8% in 2012 and 2013, respectively, its performance lagged behind that of the bull market. It was down this year, one of the people said. Mr. Eisman’s profile grew at the hedge-fund where he previously worked, FrontPoint Partners, which was once owned by Morgan Stanley and where he had managed more than $1 billion.

Besides his bet against mortgages, he was known for shorting, or betting against, for-profit education companies and lobbying against the industry in Washington. He was featured in the best-selling book about the financial crisis, “The Big Short.” [..] In a May regulatory filing, the firm wrote it believed that “making investment decisions by looking solely at the fundamentals of individual companies is no longer a viable investment philosophy.” Instead, Emrys echoed what many stockpickers have said in recent years about larger factors affecting their ability to invest as they had historically. “While individual company analysis will always be important,” it said, “the health, or the change in the health, of the financial system is the starting point of all analysis.”

The reason the Fed has become an enabler of the financial havoc it was – allegedly – designed to prevent is that large part of the banking system have never recovered from the 2007-8 crisis. Greenspan, Bernanke et al should have held all banks against a bright light, and cut out those pieces that were (are) in a too advanced state of decomposition. Doing so, however, would have been a danger to many banks around the globe, and to many of the global financial and political movers and shakers. With less and less parties available to shout that the emperor is naked, the system can only deteriorate further. All we have to wait for is for the return large investors demand on their investments, interest rates, yields, profits, to start rising.

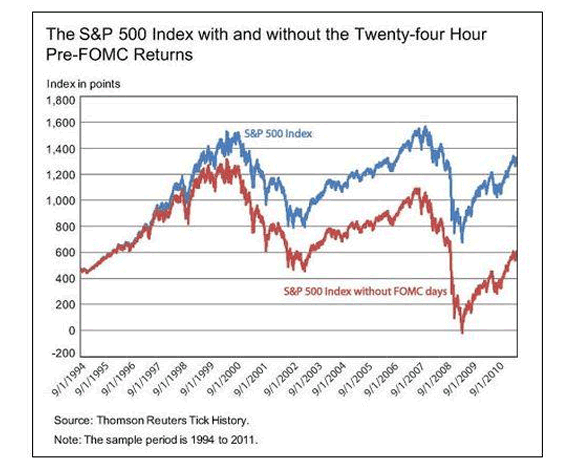

Part of what happens then can be seen in this graph published by the New York Fed in 2012. It doesn’t go beyond 2011, so QE3 is not even included yet, but the overall idea is clear: at least 50% of present stock valuations have been produced by the Fed. Says the Fed itself.

I saw that graph again in an article for Forbes by our friend and faithful follower Jesse Colombo, who selected 23 graphs that show where the dangers in our economies are. Here’s a few of them; they don’t need any further comment from me.

23 Charts That Prove Stocks Are Heading For A Devastating Crash (Colombo)

Following the bull market pattern of the past five years, the U.S. stock market continues to climb to new highs while shaking off all reasons for pessimism as well as the warnings of skeptics. Stock market bulls are becoming increasingly brazen as they drive the market to nosebleed heights, which is convincing a greater number of people into believing in the economic recovery. Unfortunately, the public is being fooled because the U.S. stock market and economy is experiencing another classic central bank-driven bubble that will end in a calamity, erasing trillions of dollars of wealth. As you will see from the charts in this article, there is so much proof that the bull market is actually a dangerous speculative bubble that it is simply undeniable. Despite what the cold, hard facts show, legions of pundits, economists, and investors are coming out of the woodwork to deny the existence of what is one of the most obvious bubbles in history. This widespread denial is what happens when emotions trump logic and reasoning.

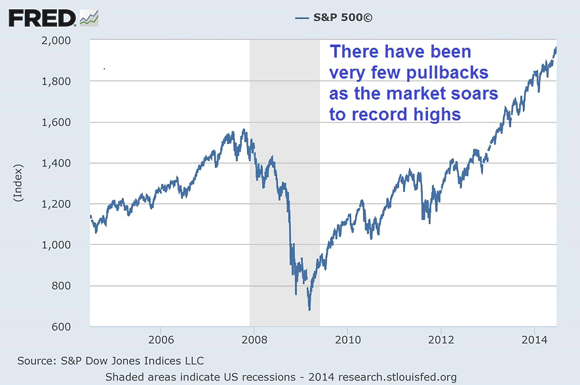

1) Since the current bull run started in early-2009, the stock market has tripled in value while barely experiencing any pullbacks aside from brief corrections in 2010 and 2011, when the Global Financial Crisis was still in full swing. The lack of meaningful pullbacks has emboldened bullish investors as market volatility and risk becomes a distant memory.

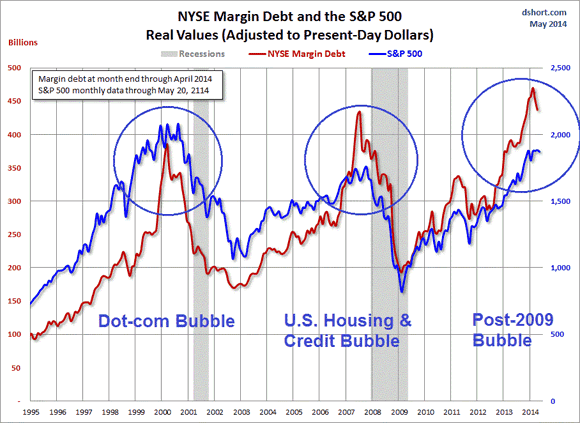

5) Record low borrowing costs and the soaring stock market has encouraged traders to aggressively use margin to finance their stock purchases, which is exactly what occurred during the Dot-com Bubble and the U.S. housing and credit bubble:

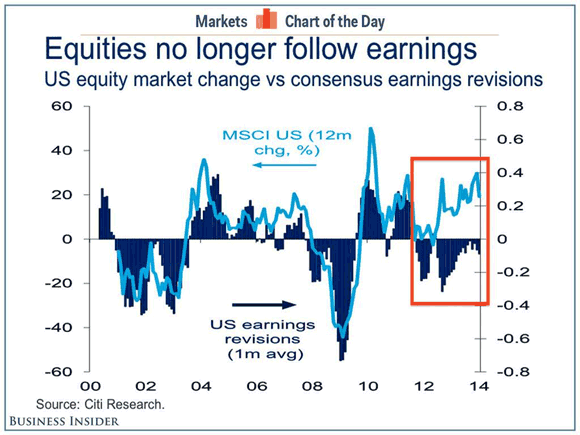

9) Stock markets become overvalued when stock prices rise at a much faster rate than earnings, which is what has occurred for the past several years:

By Raul Ilargi Meijer

Website: http://theautomaticearth.com (provides unique analysis of economics, finance, politics and social dynamics in the context of Complexity Theory)

Raul Ilargi Meijer Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.